40+ Annual extra payment mortgage calculator

Simply add the extra into the Monthly Pay section of the calculator. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Lets say you are 3 years into a 30-year 500000 home loan with a 100 offset account which you havent yet added any savings toYou have built up some money.

. 3X to 45X Annual Income. Enter your original mortgage information along with your extra payments using the calculator below to see how much interest you will save and how much sooner your loan will be paid off in full. There are options to include extra payments or annual percentage increases of common mortgage-related expenses.

Assuming you have a 20 down payment 140000 your total mortgage on a 700000 home would be 560000. When borrowers put down less than 5 they are typically charged a significantly higher interest rate to offset the additional risk the lender is taking. The mortgage calculator with extra payments gives borrowers four ways to include extra payments for their payments in case they want to pay off their mortgage earlier.

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page. Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly. This mortgage calculator with extra payment allows you to add extra contribution to every payment.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. One-time payment in dollars. The upfront mortgage insurance premium UFMPI is 175 percent of the loan amount.

The calculator is mainly intended for use by US. Calculate loan payment. The extra payment options are a one-time extra payment recurring biweekly monthly.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Most closed mortgages let you make annual prepayments of 10 to 20 without a prepayment charge. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

Annual Amortization Schedule for Your 260000 Home Loan With Extra Payments. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment.

Offset savings example calculation. Up to five recurring or up to ten one-time lump sum payments. Monthly Payment PI Pay-off Time.

While youll find PITI on virtually all mortgage payment breakdowns you may also have other expenses like. Lenders typically like to see borrowers put at least 5 down on their property. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Our mortgage calculator includes principal and interest based on your input and estimates property taxes and insurance which you can update for a more accurate monthly mortgage payment estimate. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. Few homes are built to last 100 years.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. If you receive extra money such as a work bonus tax refund or inheritance make a one-time payment towards the.

This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. MIP is used to cover your mortgage payments in case you default on your loan. Mortgage amortization schedule for year 12 2033.

Mortgage loan amount annual interest rate mortgage length and loan start date fields are required. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 2515 monthly payment. Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing.

You will spend. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Almost any data field on this form may be calculated.

Brets mortgageloan amortization schedule calculator. This calculator will also figure your total monthly mortgage payment which will include your property tax property insurance and PMI payments. You can pay off most open mortgages without a prepayment charge.

On the other hand the annual MIP rate is usually 085 percent of the loan amount.

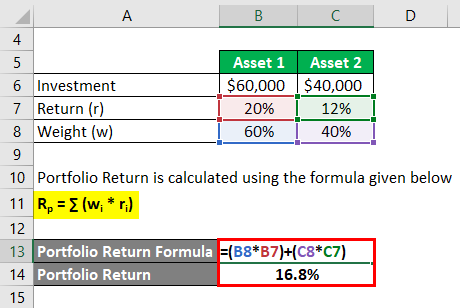

Portfolio Return Formula Calculator Examples With Excel Template

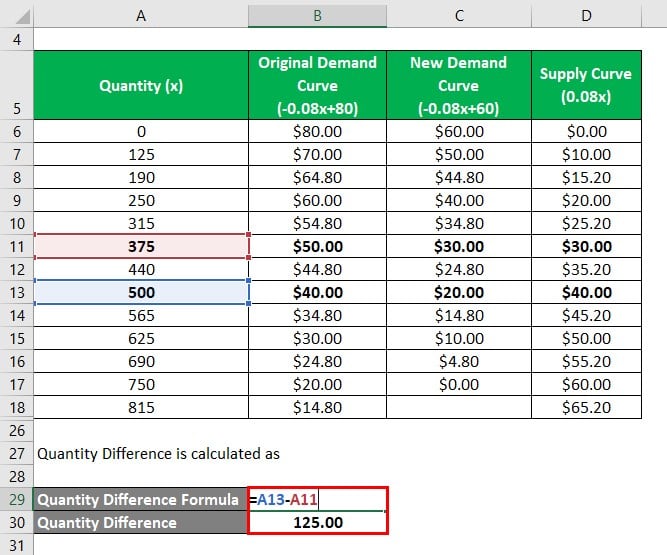

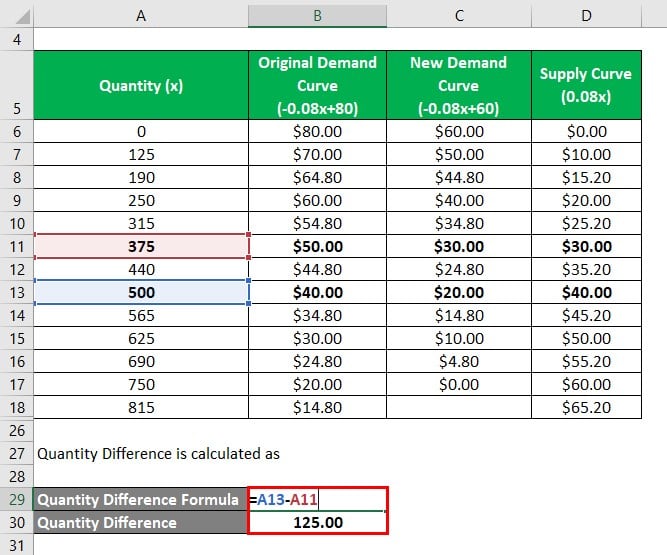

Deadweight Loss Formula How To Calculate Deadweight Loss

Use This Tri Fold Brochure To Market Your Business And Provide Customers A Menu Of Your Goods And Services With A Price Li Brochure Price List Trifold Brochure

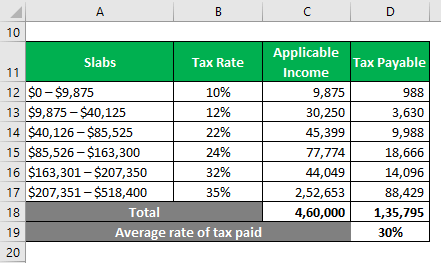

Progressive Tax A Complete Guide On Progressive Tax In Detail

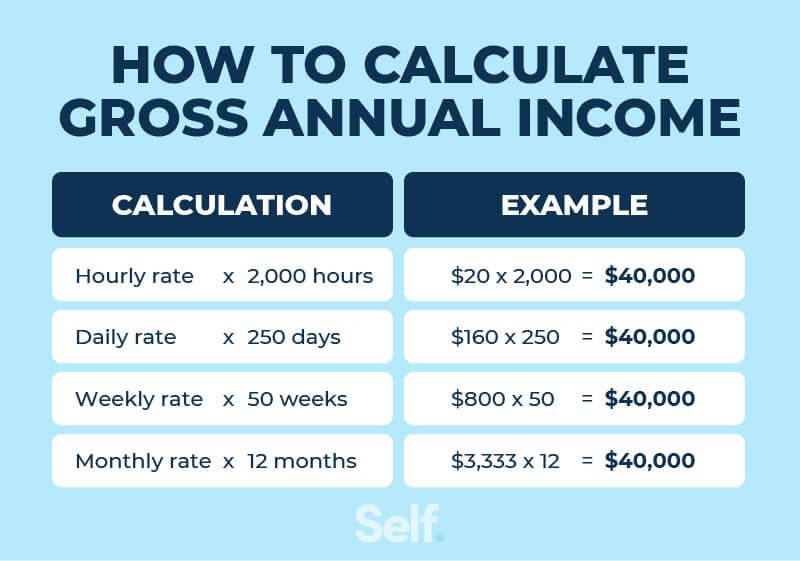

What Is Annual Income And How To Calculate It Self Credit Builder

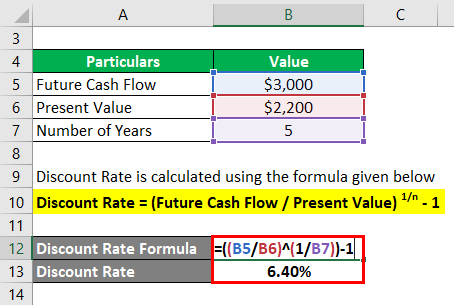

Discount Rate Formula How To Calculate Discount Rate With Examples

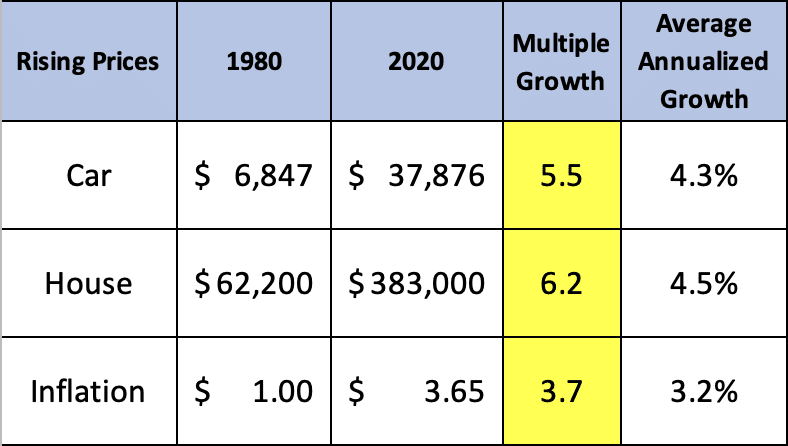

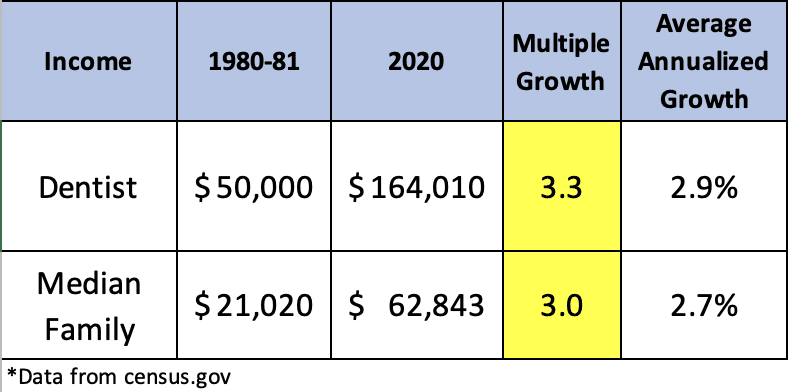

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

How Much Savings Should I Have By 40 A Retirement Savings Guide

2

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

How Much Savings Should I Have By 40 A Retirement Savings Guide

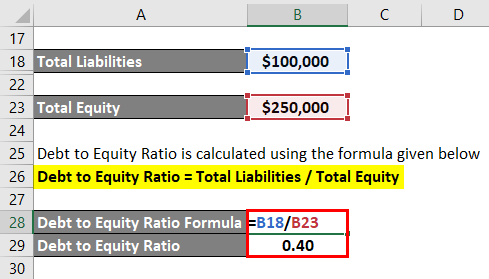

Debt To Equity Ratio Formula Calculator Examples With Excel Template

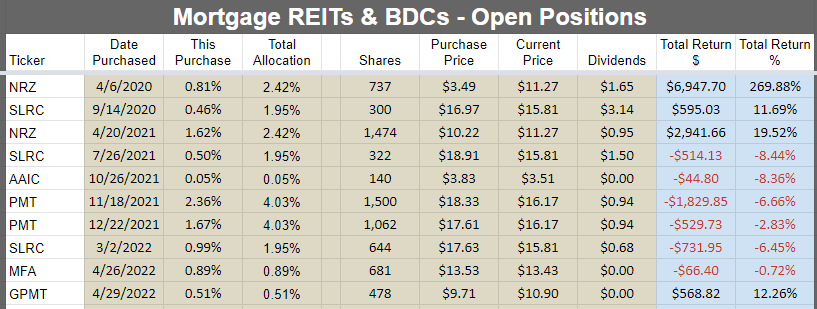

13 Dividend Yield And A Big Discount To Nav Wrecks 12 Seeking Alpha

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai